JK Cement Ltd has reported a robust financial performance for the second quarter of FY26, with consolidated net profit rising by 27.6% year-on-year to ₹160.53 crore, driven by higher volumes, improved operational efficiencies, and strategic capacity expansion. The company’s revenue from operations increased by 17.9% YoY to ₹3,019.2 crore, reflecting strong demand across both grey and white cement segments. EBITDA also witnessed a significant jump of 57.3% YoY, reaching ₹447 crore, with margins expanding to 14.8% from 11.1% in the same quarter last year.

This performance underscores JK Cement’s resilience amid fluctuating input costs and its commitment to growth through capacity augmentation and market diversification.

📊 JK Cement Q2 FY26 Financial Highlights

| Metric | Q2 FY26 | Q2 FY25 | YoY Change |

|---|---|---|---|

| Revenue from Operations | ₹3,019.2 crore | ₹2,560.1 crore | +17.9% |

| EBITDA | ₹447 crore | ₹284 crore | +57.3% |

| EBITDA Margin | 14.8% | 11.1% | +3.7% |

| Net Profit | ₹160.53 crore | ₹125.83 crore | +27.6% |

| Total Income | ₹3,070.08 crore | ₹2,598.3 crore | +18.17% |

| Total Expenses | ₹2,827.36 crore | ₹2,547.2 crore | +11% |

The company’s margin expansion reflects better cost control and improved product mix.

🧠 Segment-Wise Performance Overview

| Segment | Growth Driver | Contribution to Revenue |

|---|---|---|

| Grey Cement | Volume growth, Prayagraj unit expansion | ~70% |

| White Cement & Wall Putty | Steady demand, brand strength | ~30% |

JK Cement’s grey cement sales grew by 16% YoY, while white cement and wall putty saw a 10% YoY increase.

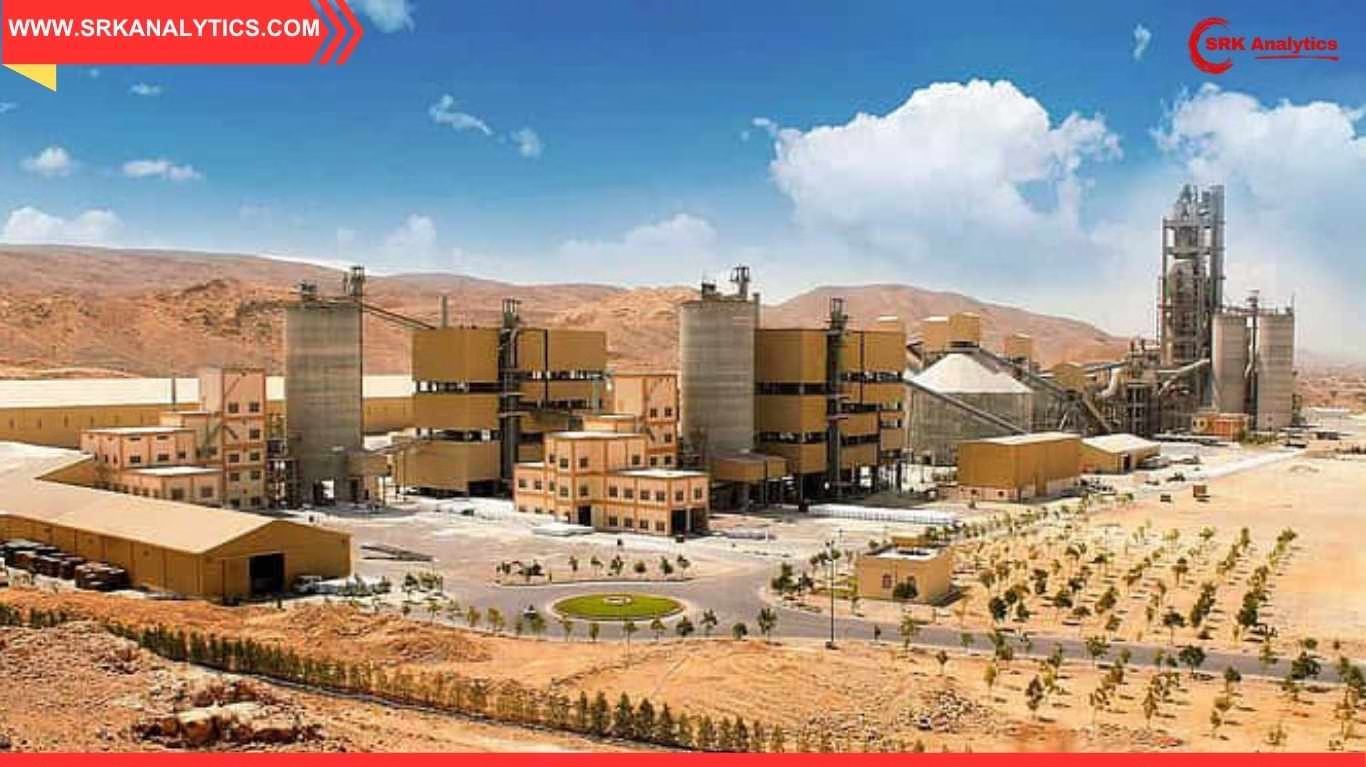

🏭 Capacity Expansion and Operational Updates

| Initiative | Description | Impact |

|---|---|---|

| Prayagraj Grinding Unit | Added 1 MTPA capacity | Total grey cement capacity now 3 MTPA |

| Efficiency Programs | Energy optimization and logistics improvements | Lowered cost per tonne |

| Digital Integration | AI-led monitoring and predictive maintenance | Enhanced plant uptime |

The company’s strategic investments are aimed at long-term scalability and cost efficiency.

🗣️ Management Commentary

JK Cement’s leadership expressed optimism about the company’s trajectory. A spokesperson noted, “Our Q2 performance reflects the strength of our diversified portfolio and operational discipline. We remain focused on expanding capacity and delivering sustainable growth.”

The management also reiterated its commitment to ESG goals and digital transformation as key pillars of future strategy.

📈 Share Price and Market Reaction

| Date | Share Price (BSE) | Change (%) | Market Sentiment |

|---|---|---|---|

| Oct 31, 2025 | ₹6,230.00 | -0.27% | Neutral |

| Nov 1, 2025 | ₹6,245.50 | +0.25% | Positive |

Despite profit growth, the stock saw muted movement, reflecting cautious investor sentiment amid broader market volatility.

🧭 Outlook for FY26 and Beyond

| Focus Area | Strategic Direction |

|---|---|

| Capacity Expansion | New units in North and Central India |

| Product Innovation | Premium cement variants and eco-friendly blends |

| Market Penetration | Deeper reach in Tier 2 and Tier 3 cities |

| Sustainability | Green energy adoption and carbon reduction |

JK Cement aims to maintain double-digit growth through strategic investments and operational excellence.

📌 Conclusion

JK Cement’s Q2 FY26 results reflect a strong operational and financial performance, with significant growth in profit, revenue, and EBITDA. The company’s focus on capacity expansion, cost optimization, and product diversification positions it well for sustained growth in the competitive cement industry. As infrastructure and housing demand continue to rise, JK Cement is poised to capitalize on emerging opportunities while maintaining its commitment to quality and sustainability.

Disclaimer: This article is based on publicly available financial disclosures and company statements. It is intended for informational purposes only and does not constitute investment advice.