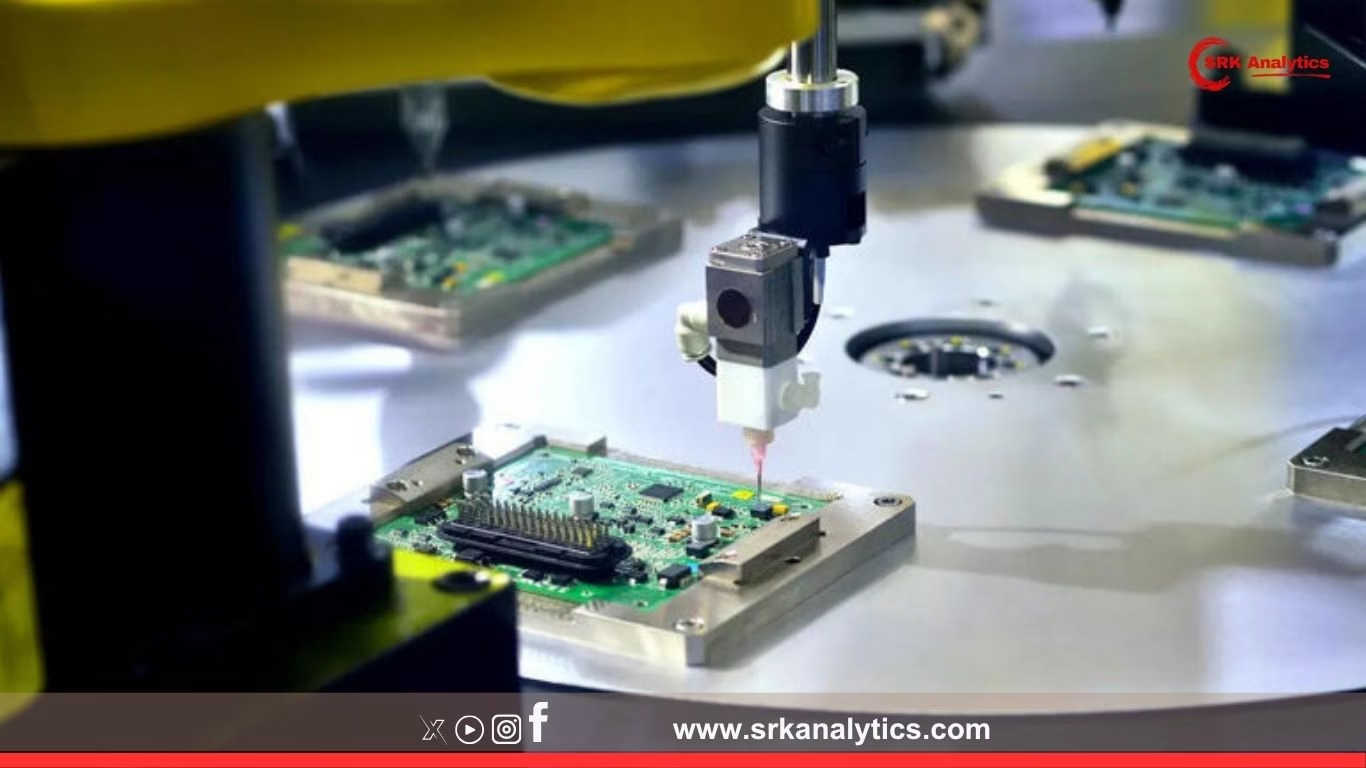

India’s electronics sector has delivered an impressive performance in the first quarter of the fiscal year 2025-26, registering a 47% year-on-year surge in exports, as per preliminary government trade data. This strong growth reflects India’s gradual but steady rise as a global manufacturing hub under initiatives like Make in India and the Production Linked Incentive (PLI) scheme.

Between April and June 2025, India exported electronic goods worth approximately $8.8 billion, compared to $5.98 billion in the same period last year, highlighting robust demand for mobile phones, semiconductor components, consumer electronics, and industrial electronics solutions.

Key drivers of India’s Q1 electronics export growth

- PLI schemes bearing fruit: The Production Linked Incentive schemes for large-scale electronics manufacturing, semiconductors, and IT hardware have attracted major players such as Apple suppliers Foxconn, Pegatron, and Wistron, besides Samsung and Dixon Technologies, scaling up exports significantly.

- Smartphone exports lead: Smartphones continued to dominate India’s electronics exports, accounting for an estimated 45% share of total electronics outward trade, with rising shipments to the US and Europe.

- Diversification of destinations: While the US remains the top buyer, exports to West Asia, Africa, and Southeast Asia have shown strong double-digit growth.

- Policy stability and infrastructure improvements: The government’s focus on single-window clearance, improved logistics, electronics clusters, and state-level subsidies has enhanced ease of manufacturing and exporting.

Major export destinations for Indian electronics (April-June 2025)

| Country | Estimated exports (USD million) |

|---|---|

| United States | 2,100 |

| UAE | 1,350 |

| China | 1,120 |

| Netherlands | 760 |

| Germany | 650 |

| UK | 440 |

| Singapore | 390 |

| Saudi Arabia | 370 |

| Other markets | 1,620 |

| Total | 8,800 |

The US retained its position as the largest buyer of Indian electronics, driven mainly by mobile phones, IT hardware, and semiconductor components. The UAE and China followed, with high demand for assembled smartphones, industrial electronics, and electronic machinery parts.

Category-wise growth trends

| Category | Q1 Exports (USD million) | YoY Growth % |

|---|---|---|

| Mobile phones | 3,960 | +55% |

| Consumer electronics | 1,320 | +42% |

| Computer hardware & parts | 980 | +39% |

| Industrial electronics | 910 | +44% |

| Electronic components | 790 | +35% |

| Medical electronics | 400 | +33% |

| Others | 440 | +28% |

Expert views on Q1 performance

Industry analysts believe India is poised to maintain this momentum through the rest of FY26 if policy consistency, input cost support, and global demand trends remain favourable. Sushil Kumar of Electronics Industry Association stated:

“We see clear evidence that government initiatives are paying off. The ecosystem for components is expanding, but further value addition is needed domestically to reduce import dependence and boost net forex earnings.”

Policy and strategic outlook

India has set an ambitious target of $300 billion electronics production and $120 billion exports by FY27. To achieve this, policymakers are focusing on:

- Strengthening semiconductor fabs to create an integrated manufacturing chain from chip to product.

- Expanding PLI schemes for IT hardware, telecom, and EV electronics.

- Building electronics clusters in states like Uttar Pradesh, Tamil Nadu, Karnataka, and Maharashtra with plug-and-play facilities and common testing infrastructure.

- Negotiating free trade agreements (FTAs) with major markets to ensure tariff-free access and boost competitiveness against Vietnam and China.

Comparative quarterly export growth (last 5 years)

| Year Q1 | Electronics exports (USD billion) | Growth % |

|---|---|---|

| 2021-22 | 2.95 | – |

| 2022-23 | 4.15 | +40.7% |

| 2023-24 | 5.98 | +44.1% |

| 2024-25 | 8.80 | +47.1% |

Industry challenges

Despite strong numbers, the industry faces constraints such as:

- Limited domestic semiconductor fabrication capability

- High import dependence for advanced components

- Global supply chain risks for critical materials

- Need for R&D investments to build global brands and IP

Conclusion

India’s 47% surge in Q1 electronics exports signifies a critical stride towards its aspiration of becoming a global electronics hub. Sustained policy support, domestic value addition, and integrated semiconductor ecosystem development remain key to ensuring that this growth trajectory continues over the coming years, fortifying both India’s economic resilience and its strategic manufacturing capabilities on the global stage.

Disclaimer: This news article is based on preliminary trade data, industry reports, and expert commentary for public information only. It does not constitute professional investment advice. Readers are encouraged to verify data and consult independent financial or industry experts before business or policy decisions.