The Central Board of Direct Taxes (CBDT) has expressed strong confidence in meeting the ambitious ₹25.2 lakh crore direct tax collection target for FY26, citing robust economic growth, improved compliance, and enhanced digital monitoring systems. The announcement comes at a time when India’s fiscal health and revenue generation are under close scrutiny, with direct taxes forming a critical pillar of government finances.

CBDT Chief highlighted that the combination of expanding tax base, rising corporate profitability, and better enforcement measures will ensure that the target is not only achievable but also sustainable in the long run. The optimism reflects India’s broader economic trajectory, where tax collections have consistently outperformed expectations in recent years.

📊 Key Highlights

- Target for FY26: ₹25.2 lakh crore direct tax collection.

- Confidence Factors: Economic growth, compliance improvement, digital tax administration.

- Past Performance: Direct tax collections have shown double-digit growth in recent years.

- Policy Measures: Simplification of tax processes, faceless assessments, and stricter monitoring.

- Fiscal Impact: Higher collections to support infrastructure, welfare, and fiscal consolidation.

🔎 Why the Target is Achievable

The CBDT Chief outlined several reasons behind the confidence in achieving the ₹25.2 lakh crore target:

- Economic Growth: India’s GDP growth continues to remain strong, driving corporate profits and individual incomes.

- Compliance Push: Initiatives like faceless assessment and e-verification have improved compliance rates.

- Digital Monitoring: Advanced analytics and AI-driven systems are helping detect evasion and improve efficiency.

- Taxpayer Base Expansion: Rising middle class and formalization of the economy are increasing the number of taxpayers.

📉 Historical Performance of Direct Tax Collections

| Fiscal Year | Direct Tax Collection (₹ lakh crore) | Growth (%) |

|---|---|---|

| FY22 | 14.1 | 17% |

| FY23 | 16.6 | 18% |

| FY24 | 19.7 | 19% |

| FY25 | 22.5 | 14% |

| FY26 (Target) | 25.2 | 12% (projected) |

🔄 Growth Drivers vs Challenges

| Factor | Growth Driver | Challenge |

|---|---|---|

| Economic Growth | Rising GDP, corporate profits | Global slowdown risks |

| Compliance | Digital monitoring, faceless assessment | Resistance from small businesses |

| Taxpayer Base | Expanding middle class, formalization | Informal sector remains large |

| Policy Support | Simplified processes, reduced litigation | Need for further rationalization |

🚀 Impact on Fiscal Policy

Achieving the ₹25.2 lakh crore target will have significant implications for India’s fiscal policy:

- Infrastructure Spending: Higher revenues will support ambitious infrastructure projects.

- Social Welfare: Funds for healthcare, education, and poverty alleviation programs.

- Fiscal Deficit Reduction: Strong collections will aid in narrowing the fiscal deficit.

- Investor Confidence: Consistent revenue growth boosts investor sentiment and credit ratings.

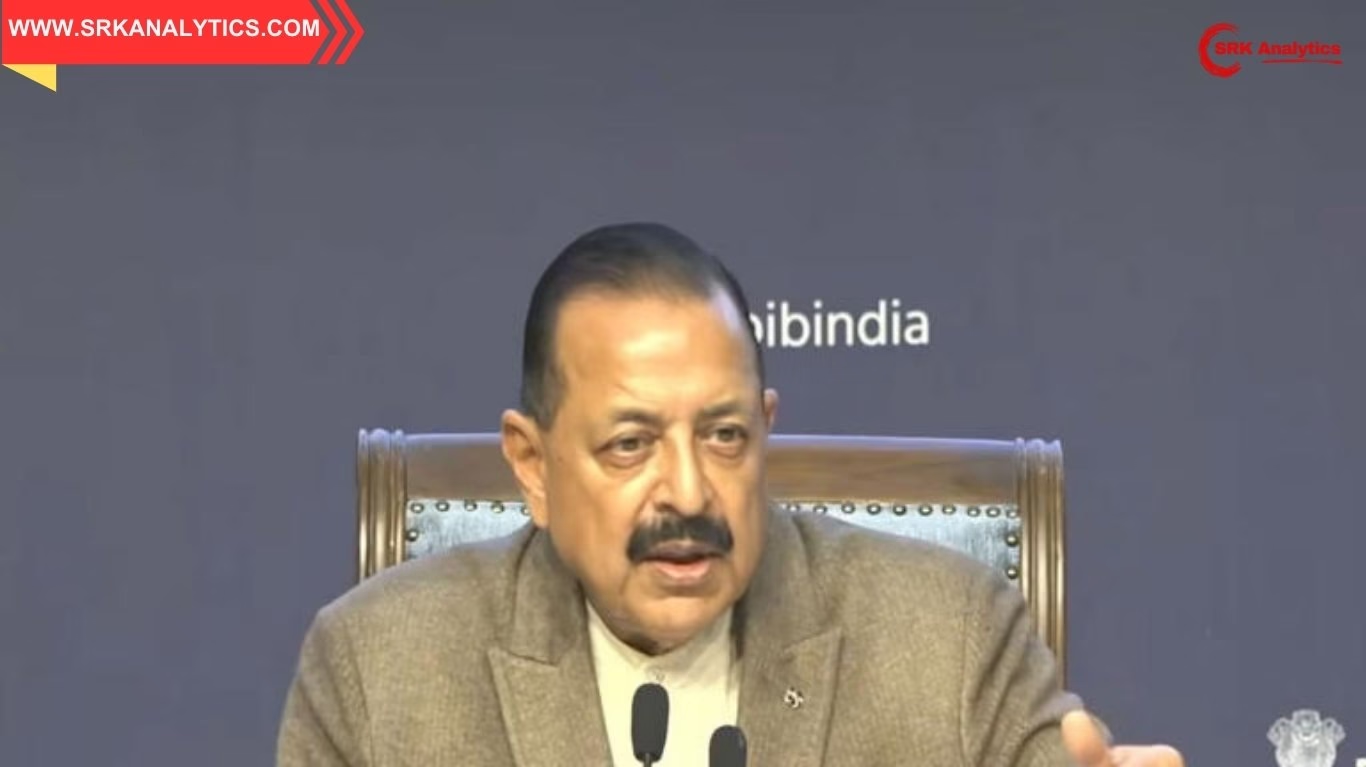

💬 CBDT Chief’s Statement

The CBDT Chief emphasized that the department is committed to ensuring transparency, efficiency, and fairness in tax administration. “We are confident that with the measures in place and the cooperation of taxpayers, the target of ₹25.2 lakh crore will be achieved,” he said.

🌍 Broader Economic Context

India’s direct tax collection performance must be seen in the context of global economic trends:

- Global Slowdown: While advanced economies face stagnation, India’s growth remains resilient.

- Supply Chain Shifts: India’s role in global supply chains is expanding, boosting corporate earnings.

- Digital Economy: Growth in IT, fintech, and startups contributes significantly to tax revenues.

📊 Sectoral Contribution to Direct Taxes

| Sector | Contribution (%) |

|---|---|

| Corporate Taxes | 55 |

| Personal Income Tax | 35 |

| Others (Wealth, etc.) | 10 |

Corporate taxes remain the backbone of India’s direct tax collections, while personal income tax contributions are steadily rising with increased formalization.

📝 Conclusion

The CBDT’s confidence in achieving the ₹25.2 lakh crore direct tax collection target for FY26 reflects India’s strong economic fundamentals and improved compliance environment. With digital monitoring, expanding taxpayer base, and robust corporate earnings, the target appears well within reach.

For India, this achievement will not only strengthen fiscal stability but also provide resources for infrastructure, welfare, and long-term economic growth. The focus now lies on sustaining momentum, addressing challenges, and ensuring that tax administration remains fair and transparent.

⚠️ Disclaimer

This article is for informational purposes only and is based on publicly available updates from government authorities. It does not constitute financial or investment advice. Readers are encouraged to follow official CBDT communications for the latest updates.